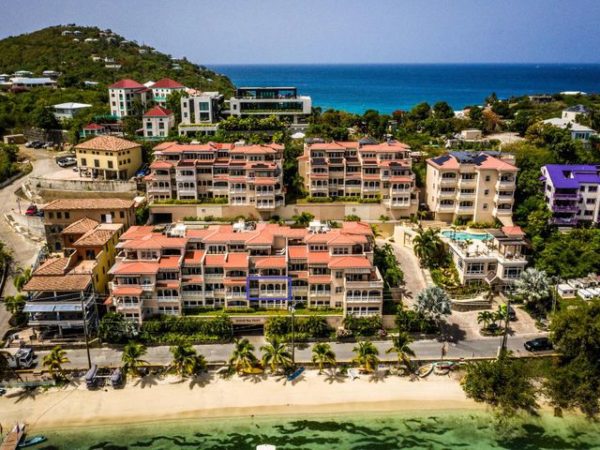

For the second time in about eight months, the Tax Assessor has issued property tax bills. The latest one, being received this week, is for 2009. Back in August, the VI government began collecting taxes for 2008.

It’s a long, complicated, woeful story about why the territory – going broke every month – hasn’t been collecting taxes for years. It has to do with the VI’s paying a consulting firm $8 million dollars to do assessments which turned out to be explosively high. And were blocked in court.

Figuring half a loaf is better than none, the Governor finally said, “Let’s collect taxes at the old rates. (At least we’ll have some income.)” And so, that’s what he’s doing, playing catch up by issuing two bills a year. Eventually, they’ll bill for 2010 and 2011.

And here’s the good news.

The bills will be at the old rate, the same as they have been for five years or so. That’s a pretty good deal for homeowners.

It’s gotta change, though. Sen. Craig Barshinger, a St.. Johnian, has legislation to try and solve the property tax-stalemate. He’s proposed that taxes be calculated using the average value of similar properties on St. Thomas and St. John.

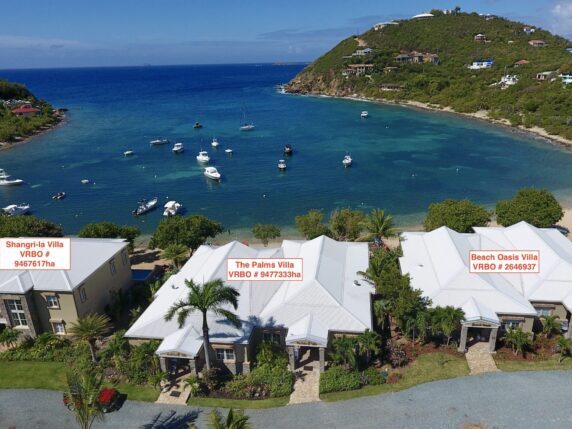

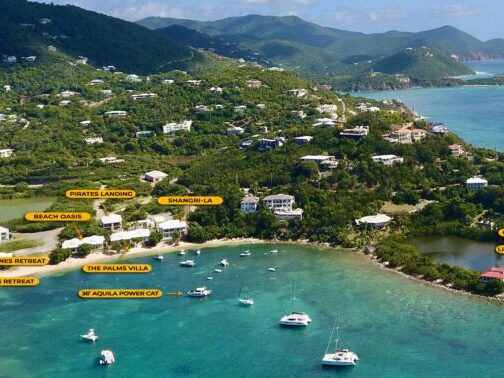

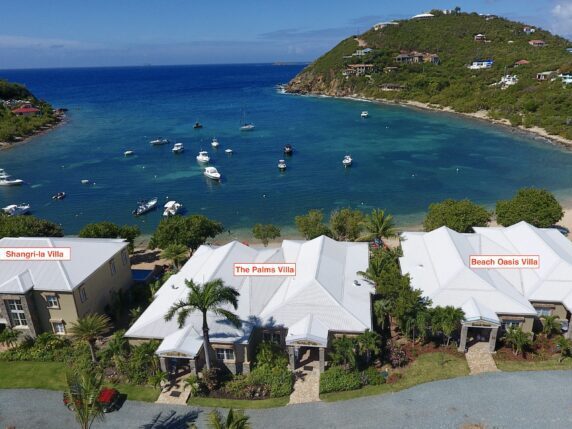

To get the ball rolling, assess the properties for sale at 70% of the listing price until it all gets “greaed out”. Bottom line, you can’t expect to have a multi million dollar villa and pay taxes based on the value of the land you bought God knows when. Likewise, locals shouldn’t get screwed just because a multi million dollar villa was built on the same road.

A distressed shanty should get taxed as a distressed shanty, a villa should get taxes as a villa regardless of what the “land is worth”

Excuse me? It’s constitutional. Taxes should be equitable between taxpayers, and are based on the presumptive market value of the property. I pay based on the value of my property, you pay based on the value of yours. The problem, once again, lies with the government. In the real world, properties are valued and a mil rate (that’s right MIL, meaning 1/1000th, not “mill”) is calculated by dividing the total annual budget to be accommodated by property taxes by the total valuation of the non-exempt property in the jurisdiction (town). Instead, brilliant mathematicians set the mil rate in the virgin islands at 12.5/1000 years ago because they didn’t want to have to do math every year. Or do the work required to fix a budget. At the same time, they’ve given HUGE breaks, that are totally inequitable, with their “tinkering” with mil rates on various property types. Guess who wins with those breaks. You buy in the V.I., you deal with the “system”, that is not unlike any other “systemized” agency in the V.I. Silliness.

Don’t forget that bills paid by 3/15/12 get a 5% discount. Mike Huntley [email protected]

Don’t know about you, but my unit has gone from valuable to worthless. It is currently worth about 25% of what I actually paid. They are still taxing me based on a fair market value assessment which bears no resemblance to reality.