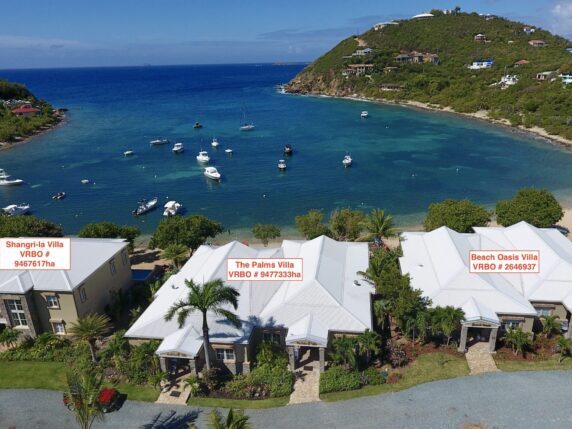

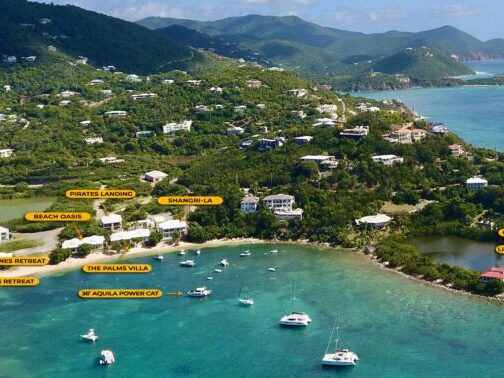

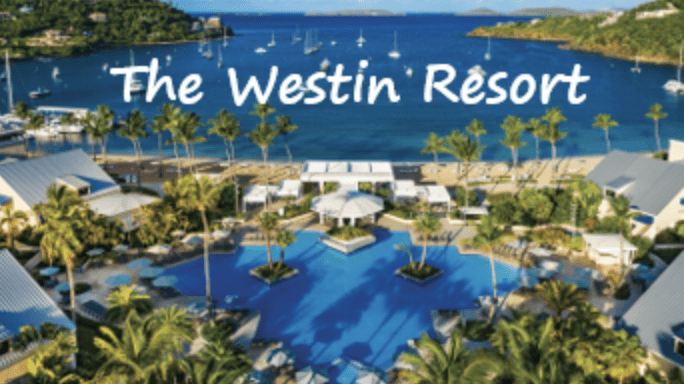

Great Cruz Bay’s S. Donald Sussman was among those quoted in a New York Times story about the Virgin Islands’ tax break designed to encourage new businesses to locate in the islands and hire employees. The Times reports federal agents have been questioning workers and neighbors about when the last time the owners were in residence. The newspaper reported the current IRS inquiry into the EDC program has allowed some island residents to “dodge an estimated $400 million in federal income taxes.”

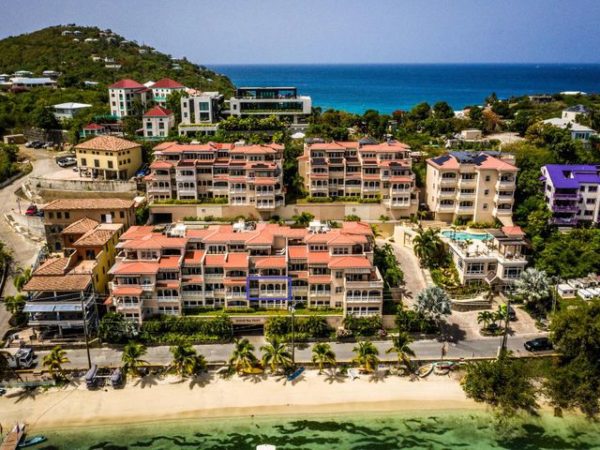

Sussman, a successful hedge fund manager, has 10 people helping him manage money in an office on St. Thomas.

Sussman worried the probe could threaten continuation of the 18-year-old EDC (Economic Development Commission) which monitors recipients of tax benefits in exchange for their operating businesses in the VIs. “I follow the rules. I do what I’m supposed to do,” he told The Times, adding he pays low taxes on income from his EDC-beneficiary Trust Asset Management, and pays full federal tax rates on the rest.

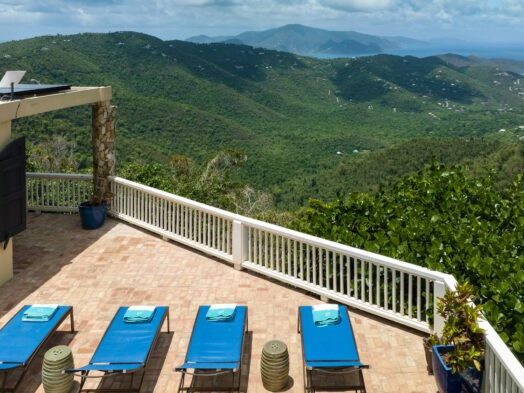

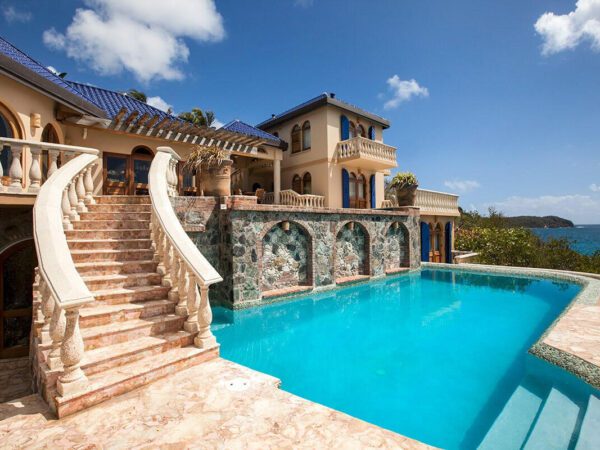

“I live on St. John,” he told The Times. Sussman is known as a generous contributor to several island charities and activities, including the VI National Park. “If what has been alleged is true (EDC company owners not living on island, but rather in the states) … (they) are engaged in outrageous behavior and potentially endangering the program,” he said.

Due to the probe, in July one EDC firm closed, and two others are reported considering shutting down, the paper said. Tax laws governing the program are ambiguous, it was said. “If something were to go wrong, it would have the impact of a major hurricane,” said Lt. Gov. Vargrave Richards. “This program is the best thing that ever happened to these islands.” The EDC was established by Congress in 1986.