For those of you looking to visit St. John, book your trips now if you’re looking to save some cash because the hotel tax is about to increase.

The current hotel tax is 10 percent, which is automatically added to any stay here on island. That rate will soon increase to 12.5 percent. It likely will go into effect in 2016.

The tax was last raised in 2010 from 8 percent to 10 percent. The new increase is expected to provide an additional $5.8 million to the territory.

To give you an idea of how this will affect your wallet, let’s take a $2,000 a week rental. Currently the hotel tax is $200. With the increase, the tax will be $250 – a $50 increase. A $5,000 a week property, for example, will increase from $500 to $625. So while it isn’t a huge increase, it’s money that could be spent elsewhere on the island like at one of our great shops, bars or restaurants.

On a positive note, there are currently a lot of great deals on accommodations being offered. Here are a few for you all to check out:

Cimmaron St. John is currently offering 15-20 percent off of select accommodations through December 15. Click here to learn more.

James M. Miller Property Management has accommodations starting at $118 a night! Click here to learn more.

VIVA! is offering a buy five nights and get the 6th and 7th nights free … plus they’re throwing in $500 in gift certificates. Click here to learn more.

Here are some more great accommodations for you to check out:

Coconuts and Plumeria:Two side-by-side villas with incredible ocean and sunset views

Bay Rum Breeze: Private villa with stunning views

Blue Palm Villa: Three bedroom home in Coral Bay; Close to everything

Serendip Vacation Condos: 15 percent off on vacations booked through November 15th

Hillcrest Guest House: Great views in Cruz Bay; Rates starts at $185 a night

Skyridge Villa: Amazing views of the Sir Francis Drake Channel and Beyond

Pura Vida: Privacy awaits you in Chocolate Hole

Croix Vista: Stunning South Shore views all the way out to St. Croix

Out of the Blue Villa: Luxury villa with 180-degree views

Suite on the Beach: A Peter Bay rental with rates starting at $250 a night

Cruz Bay Hotel: Right in the heart of Cruz Bay; Breakfast included

Island Getaways: Numerous properties ranging in price across St. John

Villa Vacations: Four villas from two to six bedrooms

Island Abodes: New, stylish and comfortable apartments right near town

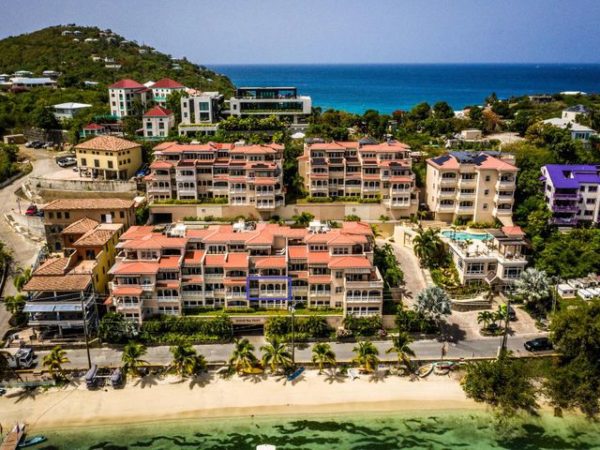

Grande Bay: Luxury resort and residence club

Westin St. John Rentals: Studio, one, two and three bedroom rentals at the Westin

Seaview Homes: Several properties across the island ranging in price, location and size

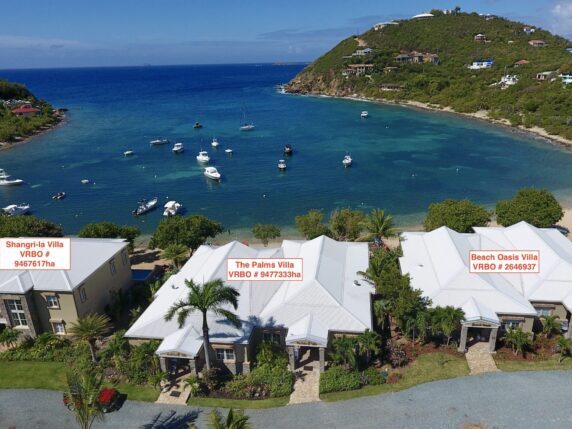

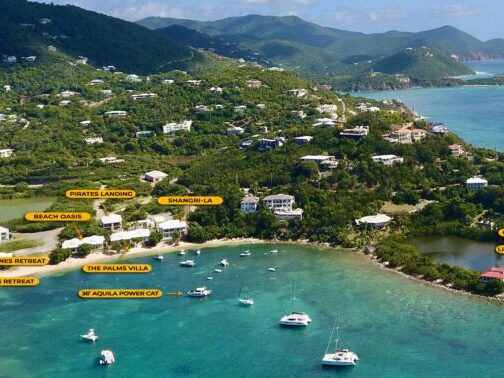

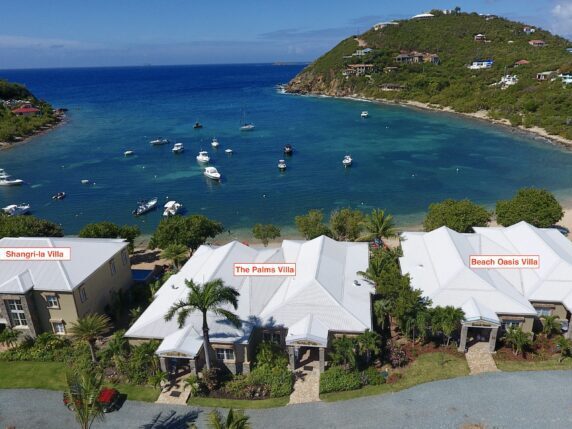

Aqua Bay Villas: Coastal elegance in Cruz Bay

Esprit Villa: Incredible BVI views from this Bordeaux Mountain villa

Alice By the Sea: Newly remodeled pool home with incredible views

Casa La Famiglia: True elegance, a Tuscan-style home

Gallows Point: A distinct and unique waterfront resort

Mare Blu: Beautiful villa with South Shore views

Villa Fish: Numerous rentals ranging in price and style

Bismarkia: Brand new luxury in Fish Bay

Hummingbird Hill: Panoramic ocean views abound

Nature Lovers: Surrounded by National Park; Rates start at $150 a night

If the tax rates go up after you’ve booked, but before you pay your final balance are they able to charge the higher tax rate?

The tax rate will apply to all new villas/hotel bookings after it has been enacted. All reservations made prior to that date will be at the old rate. So, if you have booked or are booking before it becomes law, you will be at the 10% rate.

Is this a true statement…cuz I’m getting push back from a villa rental company and Caneel on bookings I may in the summer 2015 for visits in 2016? They are telling me the rates will increase in 2016 and I now have to pay the difference. Please advise.

“The tax rate will apply to all new villas/hotel bookings after it has been enacted. All reservations made prior to that date will be at the old rate. So, if you have booked or are booking before it becomes law, you will be at the 10% rate.”

From what I’ve heard is if you booked in 2015, you only need to pay the 2015 rates.

This wouldn’t be such a bad thing if the tax money was actually used for the islands instead of lining the pockets of your crooked politicians.

You got that right…lived in the USVIs for awhile…visitors have rose colored glasses…..

It is a shame, however that is still the same as or lower than hotel taxes in Florida, where they range from 12-16%..

A 15% tax (8% sales tax plus 7% hotel/motel room tax)is added to hotel bill in the city of Atlanta. 12.5% for paradise isn’t THAT bad.