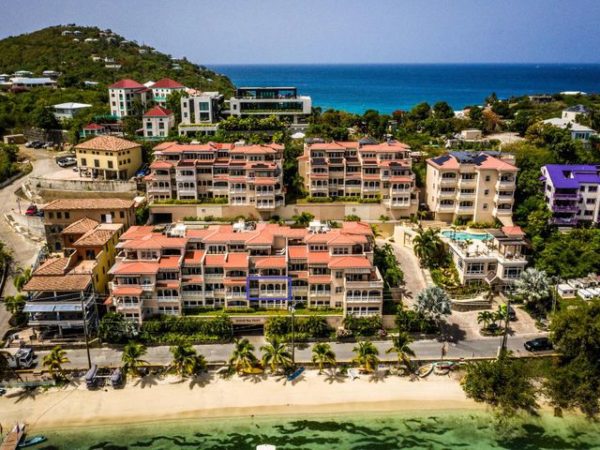

If you own a villa or a condo property on St. John, watch the mail. The result of a three-year territory-wide revaluation of property will soon be at a mailbox near you, according to the St. John Source. The Lt. Gov.’s office reported new residential and commercial valuations are being mailed this week.

Sally Powers, the project manager for the revaluation, which was conducted by BearingPoint, said her firm was still analyzing the data for neighborhood trends. Overall, residential property values increased "significantly," she told the Virgin Islands Daily News. The statements are an estimate of each property’s market value, Powers said.

The result may well be a delay in issuing tax bills for last year. Why? Read on.

Previously, it was reported commercial property values in downtown Cruz

Bay had tripled from their 1998 level. By comparison,

downtown/waterfront commercial properties on St. Thomas rose an average

of 5%, while St. Croix’s downtown Christiansted area also rose a scant 5%.

I would think you can expect the same result; that St. John residential

property valuations will soar compared to those on the other islands.

My personal bet is that this year’s tax bills will be late. Many St. John-born land owners will be aghast when they see their valuations, which have pumped up by a torrent of real estate commerce and development in the past few years. They will take advantage of the complaint and appeals offices to protest, just as you have seen happen in other resort areas that developed out of quiet towns and valleys. The system will be overloaded and tax bills are, understandably, likely to be delayed. This will go for months.

When a

tax rate is set later this year, the valuation will be used to

calculate the 2006 property tax bills. Lt. Gov. Gregory Francis said property owners should carefully review the notices and contact the Office of the Tax Assessor if there are questions. The St. John office’s phone number is (340) 776-6737.

Just got mine in the mail – WOW. From the assessor’s mouth to God’s ears – if I could get that for my land – I’d sell it in a heartbeat!!! Now, where do I go to start the protest process?

Barbara …

haven’t seen our valuation yet …

I do think the appeals process will overwhelm the system (there’s a system?) – one guy at chocolate hole says they’ve assessed him as 4 BR when he’s got 3 … so that kind of confusion will also gum up the works.

What I think will happen, however, is that the huge real estate valuation gain on ST J will really tip the truck … St J will pay for much much more of the territory’s budget and get you-know-what.

Frank

My new valuation for our land is also rather high. It’s certainly more than I would expect to get if I listed it for sale.

It’s more than 6 times the previous value! Hopefully, they will lower the tax rate as they have promised.

Hey, the previous value was too low so it had to go up but this is a bit crazy.