Well folks, we tend to shy away from topics like politics, but today we’re going to make a brief exception.

Yesterday, Governor Mapp signed several news bills into law. The most controversial one, and the one that will presumably affect the majority of us the most, has been dubbed “the sin tax”.

When the Governor first released his sin tax plans a few months back, he called to increase the tax on a case of domestic beers from $1.55 to $11.55, the tax on foreign beers from $2.08 a case to $14.08 a case, and the tax on wine, spirits and other liqueurs to 10 percent of their value. Finally the Governor proposed a $30 per day tax on every timeshare unit for each day of occupancy in the Territory.

We heard that the numbers decreased a little bit prior to the signing of the bill, but as with most government things down here, the exact figures have been shrouded in secrecy. As soon as we know the exact figures and how it will affect bars and restaurants, we will certainly let you know.

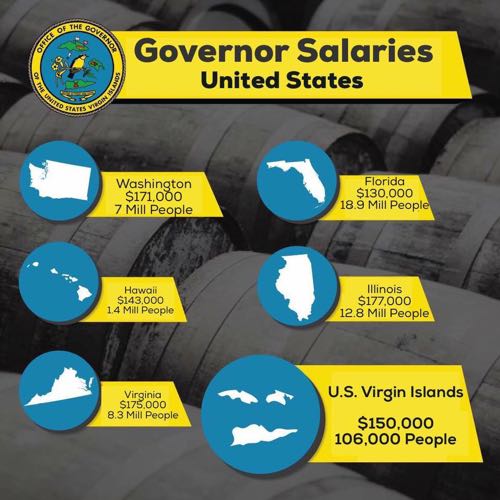

The Governor thinks the sin tax is a great way to increase revenue in the territory, which pretty much relies on tourism. It’s pretty comical coming from a man who makes $150,000 a year to govern just over 100,000 residents and lives at the Ritz Carlton. Check out this great infographic courtesy of the Say No to Sin Tax USVI Facebook page. It really highlights how outrageous Mapp’s salary is when compared to other governors.

Again, we will keep you all posted on the numbers as soon as we know more. In the meantime, go grab a $1 happy hour beer while you can folks! 🙂

Unbelieveable! Why didn’t they just implement a regular tax on everything and forego the ‘duty free’. NOT HAPPY!!

I’m confused. How can they charge a tax on timeshare unit usage? It’s one thing to charge a tax to renters, but we are owners, just like anyone else who owns property on Island????

It is the governments way of getting the occupancy tax back out of all the hotel conversions to timeshares.

St John is a very beautiful and expensive destination. We have visited there the last four years but will probably re-think future trips.

Time to sell my timeshares and go elsewhere! Between increased maintenance fees taxes and now an additional 200/week? I can go somewhere a lot nicer for those dollars! Or just stay in a hotel instead!!! Bad decision by the USVI government for sure!!

I have already moved on to a location with a much less spring break fee!l-Try Turks and Caicos!

This is not a good plan. I love the USVI, but if my tourism dollars go farther somewhere else, I’m more motivated to travel to other destinations instead.

That’s so ridiculous they need to rethink that law because there goes their income for the islands

This plus the hotel per day tax.. is a sin, it will drive tourists to other locations

Well we’ll be headed over next week. If we see a big difference in our expenses it will be our final trip to USVI. Trigger to head down to the lower islands.

To all of the locals there, I’m sorry to hear you are experiencing politics Southern California style.

Good Luck

Typical political hack trying to squeeze more money OUT of a local economy. Moron doesn’t even realize that it will cost more that it makes in lost tourism revenue at bars and restaurants. If there is ever a group of people in the world that can guarantee to screw up a good thing, its politicians.

Stupidly biting the hand that feeds them instead of working on getting rid of waste and corruption. They’re going to tax themselves right out of the very thing that supports them and the residents of the island. Oh well, they can always get more $$ from Washington.

I’ve been coming down every year for a decade and during that time I’ve seen prices skyrocket in all aspects of the tourism industry on STJ. Boat captains, boat rentals, ferries, meals, drinks, and places to stay. I’m putting my time share on the market and finding another place to go. The days of Woody’s and all the other quaint little reasons I fell in love with STJ are being left a stern. Good bye my little hippy village. Just another victim of corruption and greed…..sad.

That is exactly what it is, corrupt politics. The write ups on USVI that I have often read apparently are showing their true colors on mob-ran employment infrastructure in St. Thomas/St. John.

Seems the real Sin here is the greed creeping into St John. Its been our “go to” location. Our entire family has fallen in Love with the island but between adding such a huge tax that will of course trickle down in an area that is aleady expensive and pushing forward on plans for the marina/ resort in the Coral bay area St John is starting to loose its lure…..please think things through!

Very sad to see this but glad it happened before we moved there. We visited 4 months ago and decided to sell our resort here in Wisconsin and make the move. Hope and pray the good people of St John’s don’t suffer because of this short sighted law.

Looks like tourism will drop off and those 150K folks will be all that may be left to pay those taxes! Get up stand up stand up for your rights!

That’s crazy, shows nothing but greed. We will go elsewhere. Sorry for the people of St.John they will be the ones to suffer. Vote out that nutcase!

It’s not just Mapp, this unpopular bill was sponsored and passed the the VI Senate. In the future please consider disseminating the bill #, St John Senator name and contact info while the legislation is under consideration and maybe the outcome could be different. It only takes 5 outreaching constituents for a representative to take notice. This info is easily obtainable at http://www.legvi.org.

This will better the economy of Exuma which has been our USVI replacement for our winter holiday.

Wow…such an even split with the comments (end sarcasm font). If everyone is against it, who is for it? We are going to St. Croix in two weeks. Will this apply to that island as well? Still the USVI, right?

Doug, this applies to the entire USVI. Not just St. John. All the islands rely on tourism.

Well, Somebody voted for him!

The problem isn’t necessarily greed. It’s mismanagement. The USVI government spends more than it takes in. So instead of fixing the problem they just try to ignore it by raising taxes to cover it. They need to look at their expenditures. I think it’s pretty evident the level of corruption in the VIs. Everybody and their brother is on the government payroll. If they aren’t value added, cut them off. But that’s not going to happen if those that need to be cut off are, or are supported by, the majority of the voters. It’s a vicious cycle. And they simply decided to let those that pay the bills just pay a little more. Problem is the negative response from that is going to ripple through the tourism industry. Look at Panama City, FL. They no longer allow alcohol on the beach during the month of March. That’s when most bars and restaurants make a VERY large percentage of their annual income. But the customers stopped coming. STJ is already pretty expensive. I think this is going to raise the bar just out of many a tourist’s threshold for pain.

WTF . Hey, Gov. Bite The hand that feeds you, DA………

Oh my a corrupt Caribbean government? You doneed have to look past the VIPD subscribe taking all the parking spots to see it. VIPD such per capita on St John… love to know that stat.

Yes auto correct screwed that up. SUVS not subscribe or such

Can a petition be started to stop this madness?

the “petition” will be the next election. Huge push to not vote for any Senator that voted for this sin tax

Last time I’ll be there. So sad. Didn’t he hear the saying cutting off your nose to spite your face. Bad decision for tourism.

Is this Gov and the lawmakers in the VI’s out of their minds!! Quite obvious things are totally out of control in the way government is run down there. Something must be done, this can’t stand. Tourism won’t survive!! What’s a case of Corona/Hieneken going to cost $50?? How about the bar owners having to pass down the cost to customers? So long Happy Hour:(

The number one revenue stream is tourism. This will kill tourism and end up costing the islands in the long run.

Although the theory behind this tax is highly flawed and the timeshare owners are taking a hit( if in fact it taxes them rather then when they rent) I find it ridiculous that people threaten to not come to the VI anymore over this. I mean, so this increases the cost of a beer less then $0.50. Fifty cents!!! So let’s just say you drink 50 beers on a weeks vacation, which is plenty, that increases your cost $25. BOYCOTT for life!! But sure go to another island. Sit on the beach for one minute and be harassed by every vendor you’ve ever imagined selling beads and bob Marley t shirts and whatever. Bet you buy $25 worth of crap.

That is kinda what I was thinking. Drastic change but maybe necessary. I wonder if consultants could be employed to determine where the $ is being spent inefficiently and how to get things back in balance. For 150000 people it seems like it could be possible, where it wouldn’t be feasible for a larger place.

One can disagree with the tax and not be misleading. The figures is not “shrouded in secrecy”. It was actually publicly debated and voted on by the Legislature and then the Governor took 10 days to review before signing.

I live in Mass. I could take a direct flight to Bermuda, 90 minutes. I don’t. Why? The local government has jacked up the prices of everything on that Island. Booze, food , hotel taxes. So I don’t go there and neither do a lot of others.

The VI is a great place to vacation. But I don’t NEED to go there elther.

Me and my husband have been vacationing on St. John for the past 18 years, 2 weeks late in spring. The cost of beer and booze won’t effect our future plans. Where we come from it is a bargain if you get a $5.00 happy hour beer. Booze is way more expensive on stateside.

See you April 29th. Cheers.

Agree with Marketta and Wonderlost… see you in December.

I don’t have a problem with the alcohol tax. What I have issue with is the TS tax added on to the property tax that I already pay. This is effectively doubling my property tax (more if I stay in a smaller unit for a longer stay.) My property tax is billed separately from my TS maintenance fees, so I know the USVI govt is receiving it.

Marty T, this is not the forum for racist comments. Please leave it elsewhere.

I just saw that comment now and promptly deleted it. Sorry about that George.

have been comming her for years. will not be back. time to check out other options with our time shares. love stt. but not by 30 dollars per day. been here for 10 day and already spent over 1200 dollars and have four left.energy tax car rental. shopping at cost u less. food towm and supporting many resturants and excursions. enjoy your transfer day as we transfer out points to another island.

I don’t know what Gov Mapp eats at the Ritz but I won’t be paying for any of it. Visit yearly but not anymore. The beaches at Clearwater Florida sound good now.

The $25/day tax on timeshares just killed my intention to make St Croix a regular destination. Ironically, the tourism bureau just spent many thousands promoting a “we will pay you to come to USVI” campaign and then the government announces an additional fee. “Hello, Right Hand… Left Hand Here. We should talk!” What a terrible way to improve tourist numbers. There are lots of other lovely islands that would be delighted to simply take my cash for real things.

I just heard from the place we booked our July vacation and they told us the fee for our rental is going to be an extra $25/per day. We will pay because we have no other choice but it will hurt tourism because that’s an extra $350 that we will not have to spend out in the economy on food, excursions or at local shops. This SIN tax will defiantly hurt the USVI.